C&G Group

The main purpose of the company is to carry out activities related to the real estate sector, as well as investment in shares of private companies. We also offer advisory services in capital and infrastructure investments, and we are dedicated to the purchase and sale of services and personal property to both domestic and foreign suppliers, as well as providing financing for different types of services such as personal property, real estate and shares.

Our experience and knowledge in the market allow us to offer comprehensive financial solutions tailored to the needs of our clients. We pride ourselves in staying at the forefront of the latest trends and investment opportunities, always seeking to maximize value for our clients.

On the other hand, we have a solid portfolio in gold and crypto-assets and we carry out futures and spot trading operations, as well as equity investments in the stock exchanges both globally and domestically.

Likewise, we are open to explore new opportunities for collaboration and we are confident that our company can bring value and growth.

Who Are We?

We are a group of experts in the field of cryptocurrencies, driven by innovation in science and technology. Together, we form a multidisciplinary team aimed at providing efficient solutions in the management and transfer of digital value in the emerging market of cryptocurrencies. We have qualified and experienced personnel in cryptocurrency management and market consultancy, with expertise in finance, particularly in dealing with the volatility associated with cryptocurrencies. Given the novelty of this market, we also have a legal team specialized in blockchain and cryptocurrencies to offer relevant advice and ensure the necessary operational support on a digital value exchange platform.

Our Mission

To provide a digital platform for the exchange of value, where any individual can access the national and international cryptocurrency market in a practical and secure manner. To offer the service of buying and selling crypto assets in both national and foreign currencies, both within and outside the national territory, in order to establish the autonomy and sovereignty of our nation in this emerging market. To create value for all those unbanked individuals who, for various reasons, are excluded from the modern financial system, by providing tangible benefits to their lifestyle and bringing our country closer to the highest standards of international monetary services.

Our Vision

To position ourselves as a national reference in the digital exchange of value related to crypto assets. To establish our country as a powerhouse in the crypto assets market by implementing a digital exchange with the highest standards of transparency, security, and functionality in the world.

Our Offices

United Arab Emirates

USA

South America

C&G GROUP TRADING

What Is Trading?

Trading is the buying and selling of financial assets, such as stocks, bonds, currencies or cryptocurrencies, for the purpose of making profits through price speculation. traders use analysis and strategies to make informed decisions in a market that can be volatile and is driven by economic and political factors. Risk management is critical to making prudent financial decisions during trading.

Main Objective Of Trading

We are a group of experts in the field of cryptocurrencies, driven by innovation in science and technology. Together, we form a multidisciplinary team aimed at providing efficient solutions in the management and transfer of digital value in the emerging market of cryptocurrencies. We have qualified and experienced personnel in cryptocurrency management and market consultancy, with expertise in finance, particularly in dealing with the volatility associated with cryptocurrencies. Given the novelty of this market, we also have a legal team specialized in blockchain and cryptocurrencies to offer relevant advice and ensure the necessary operational support on a digital value exchange platform.

Types Of Trading

Intraday Trading: in this type of trading, trades are made within the same day. traders open and close positions over the course of a few hours or even minutes. they seek to take advantage of small fluctuations in prices to make quick profits.

Swing Trading: traders who practice swing trading hold their positions over several days or weeks. they seek to profit from broader price movements and medium-term trends in the financial markets.

Position Trading: in this approach, traders hold their positions for much longer periods, which can extend from weeks to years. the objective is to take advantage of long-term trends and make significant profits with a lower trading frequency.

Scalping: scalping is an intraday trading strategy that is characterized by making a large number of operations in a short period of time. Scalpers seek to make small profits by taking advantage of very small and rapid price movements in financial assets. They usually keep their positions open only for a few seconds or minutes, and seek to accumulate profits with each successful operation.

Trading Operations

Spot in Cryptocurrencies: In this operation, investors buy or sell real cryptocurrencies at the current market price, without leverage. Profit or loss is calculated based on the difference between the purchase price and the sale price.

Cryptocurrency Futures involve investors agreeing to buy or sell futures contracts representing cryptocurrencies at a predetermined price for a future date. Leverage is used, which magnifies both potential gains and losses. The results are based on the settlement price of the contract compared to the entry price.

For instance, if an investor has $1,000 in their trading account and chooses to use 10x leverage, they can control a position of up to $10,000 in the market. The leverage, in this case, is 10 times the initial capital.

Leverage is facilitated through loans provided by the broker or trading platform. When an investor opens a leveraged position, the broker lends them a portion of the capital needed for the trade, and the investor contributes a part as an initial margin.

It’s crucial to note that leverage can increase both potential profits and losses. If the trade is successful, the investor will make a profit on the total position amount, not just their initial capital. However, if the trade goes against expectations, the losses will also be amplified and could surpass the initial capital.

Capital Management At C&G GROUP

Our Work Approach

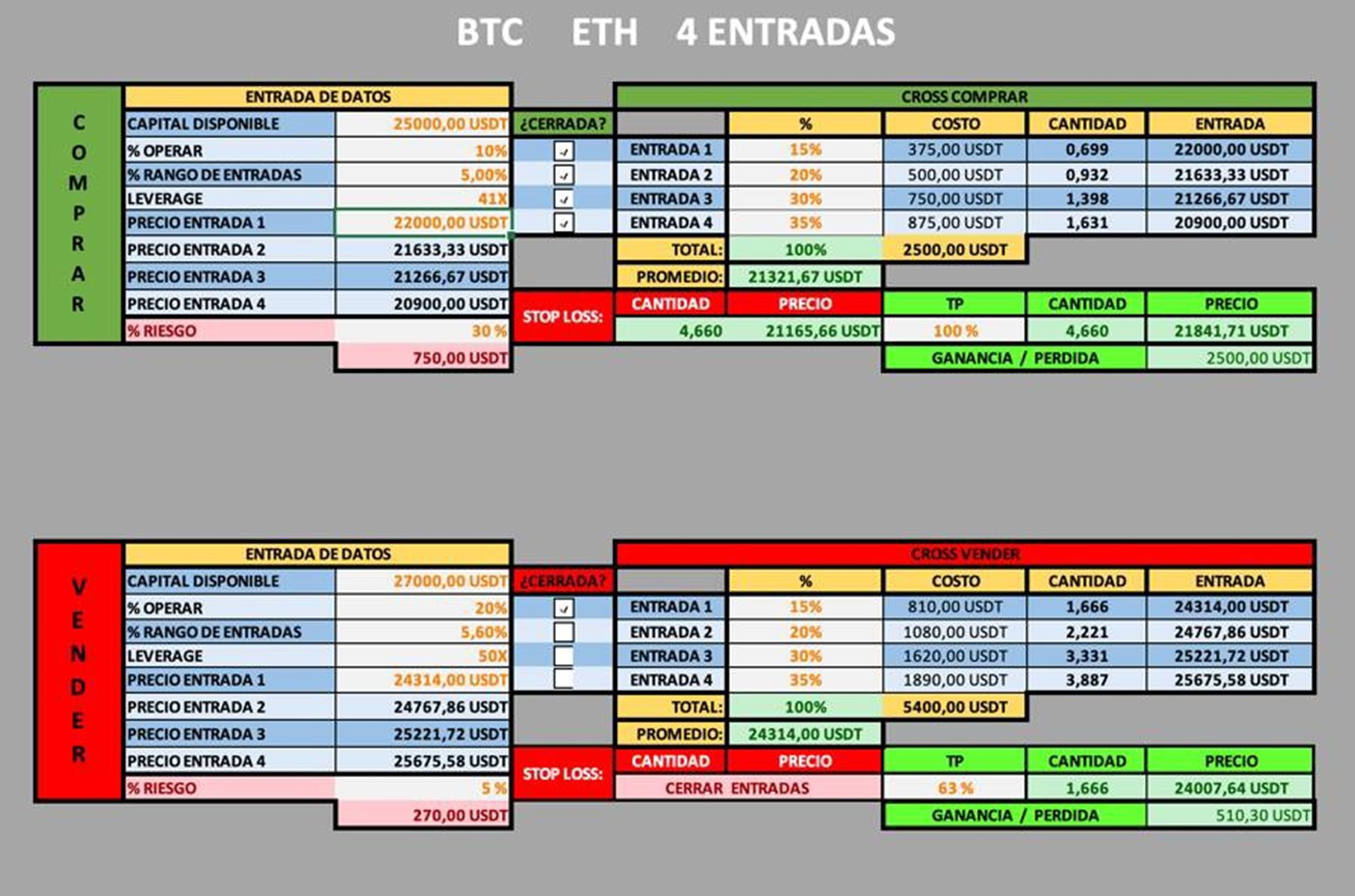

In our company, we have a team of highly trained expert analysts, who are responsible for conducting an exhaustive analysis to identify the best opportunities for market entry and thus obtain optimal profitability in our operations. Our approach is based on the application of rigorous risk management, limiting the assumption of losses to the maximum of 5% in and accuracy in our analysis and strive to maintain a high level of success in our operations. We are committed to excellence and continuous growth, which allows us to offer sound financial solutions tailored to the needs of our clients. In the charts presented, there are several important points to consider when planning a trade. First, we evaluate the relevant zones in the temporality of the chart, which in this case is 4 hours, for the planning of an intraday trade.

Planned Trade: Example Of The Operation

Long BTC/USDT

Considering a capital of $1,000,000 and using 20% per position, the margin used would be $200,000.

Entry point: The value of BTC is $16,373.

Take Profit: It is set at $17,100, representing a profit of 5.45% ($10,900).

Stop loss: It is placed at $16,100, assuming a loss of ($2,840), equivalent to 1.42%.

In terms of general capital, this operation would yield a profit of 1.90% and a risk of 0.142%. By making about 5 to 8 trades per month, you would accumulate approximately 15% in profits, with a 5% loss limit assumed only from the account profit, not the initial capital.

It is important to note that this is just one example, as the results of a trade can vary and profits of up to 20% could be achieved.

Formula To Plan A Trade

Bitcoin Macro Analysis

Bitcoin analysis in weekly temporality gives us a more complete and reliable perspective to make informed decisions in the exciting world of cryptocurrencies.

In the following graph, an analysis of Bitcoin in temporality is presented weekly. First, wave 1 stands out, generating a strong impulse towards a possible resistance zone. Subsequently, the price experiences a retracement, evidenced by an absorption candlestick in wave 2, located at an important support level. This allows us to speculate on a new uptrend, given that the new low is higher than the previous one.

At wave 3, BTC reaches another significant point, identified as a resistance zone that was previously a support level. The price rejects this zone and there is a retreat towards a specific support and the previously drawn speculative trend line. Currently, we are in wave 5, which is considered the last impulse in the context of the analysis of Elliot Waves.

Based on this analysis, it is expected that the next market movements will resemble the movements observed at the ABC points, so that later the Bitcoin continues with its bullish trajectory.

This analysis provides us with a strategic and well-founded vision of the behavior of Bitcoin in the framework of weekly temporality, which allows informed decisions to be made in the context of investments and trading in this digital asset.

Long SOL/USDT

The following analysis shows the SOL/USDT pair based on our technical analysis saw a possible opportunity for a bullish bounce to the marked lines. Result of the previous analysis which was 7%

Planned Trade: Example Of The Operation

Long SOL/USDT

Considering a capital of $1,000,000 and using 10% per position, the margin used would be $100,000.

Entry point: The value of the SOL is $23,147.

Take profit: stands at $23,386, representing a 1% profit on Spot and Futures at 10X (10%).

Stop loss: stands at $22.89, assuming a loss of 1% on Spot and Futures at 10X (10%).

In terms of general capital, this operation would yield a profit of 1% and a risk of 1%. By making about 16 to 20 scalping trades per month, an approximate 18% in profits would accrue, with an 18% loss limit assumed solely from the account profit, not the initial capital.

It is important to note that this is just one example, as the results of a trade can vary because, not all trades are strictly with a 1 to 1 risk/reward.

Planned Trade: Result

Completed Analysis: Part Of Our Approach

Monthly Earnings Rate On Futures 36.67% Per Month

Quarterly Spot Earnings Approximately 15% Per Month

Market Outlook

Blockchain technology and all its related products are poised to be a disruptive force on our planet, with tangible implications in the financial sector, where we can already see recognition of the revolutionary potential of this promising innovation. The implications of adopting this technology cannot be underestimated, nor should they be confined solely to the financial spectrum.

The potential is overwhelming, and like any project of this magnitude and with these characteristics, it is understandable that understanding its ramifications and possible impact on our society is challenging. That’s why we must look beyond the traditional, and the opportunity to position our country as a hub for adopting this technology could easily be a turning point in the history of our technological development as a nation, and we are still in time to achieve this premise.

Given the growing boom and excitement surrounding the cryptocurrency market, it is necessary to have an autonomous and sovereign platform that serves as the necessary vehicle to propel technological advancement and economic independence in our country. For this objective, it is vital to have a wide range of functionalities, making the most of current development elements while constantly seeking the integration of new concepts that allow us to create value through innovation and the application of disruptive ideas.

Mass adoption is a key pillar for the success and development of this technology, making it crucial to provide a user-friendly tool to access the market, which carries immeasurable value. By doing so on a platform with national roots, we bring value and a universe of possibilities for the growth of our economy.

Market Positioning And Competitive Advantages

Our platform aims to position itself as a pioneer among digital exchange platforms in our country, catering to both local and international needs by providing a quality and innovative service.

Through an aggressive and detailed marketing strategy, it is essential to establish our brand as a mark of excellence in digital value exchange of crypto assets, offering multisectoral and targeted advertising to individuals and businesses seeking exposure to the market related to our services.

By setting up a physical operational headquarters, we can provide a service that instills the necessary confidence and corporate sobriety that a venture of this kind requires.

Once established as a leading brand, we will seek to expand our reach within and beyond the national territory through marketing and other related business strategies.

Through forming commercial alliances with wallets and payment gateways, we aim to be the driving force that enhances and maximizes adoption within the national territory.

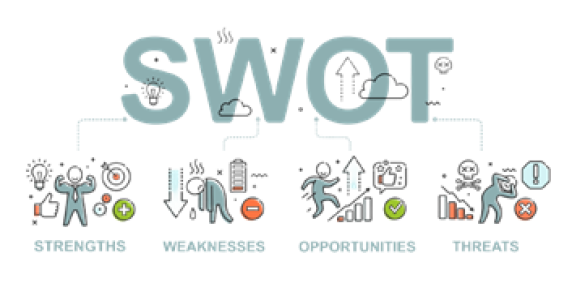

SWOT Analysis (FODA)

Strengths:

Platform designed for national operations.

Easy exchange of cryptocurrencies to local currency.

Operational cost advantage compared to international platforms, allowing us to provide quality service with a competitive commission scheme.

Opportunities:

Highly motivated domestic market in the sector.

Current economy facing various challenges.

Weaknesses:

Established international competition.

Untapped market in the national territory.

Monetary policies against our country that may impact the platform’s international image.

Threats:

Market volatility.

Arbitrary blocks by certain countries as an extension of international sanctions. • Inherent technical security risks in the business model.

Additionally, the company will continue to project transaction volume growth during the 6-month period, aiming for 0.1% to 0.5% of the total monetary base volume.

Over the first 5 years, the company’s ambition is to attract users, significantly increasing the user base to reach one million users.

In terms of monetary volumes, the company has projections to achieve a monthly movement of approximately 100 BTC within this 5-year period. These financial projections will be instrumental in guiding the company’s growth and expansion strategies while aiming to maintain a sustainable and competitive position in the market.